Article Directory

Kyle Busch's $10 Million Loss: Due Diligence, or Just Bad Luck?

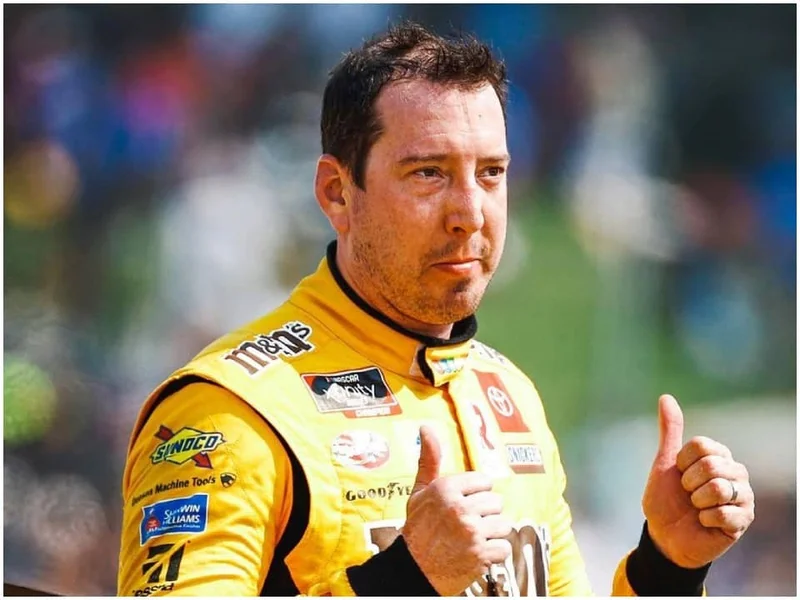

Kyle Busch, the NASCAR star, claims he and his wife lost a staggering $10.4 million in just 16 months. The culprit? A complex Indexed Universal Life (IUL) insurance policy pitched as a tax-free retirement plan. The Busches are now suing Pacific Life and its agent, alleging misrepresentation and false promises. The core issue seems to be a massive discrepancy between projected returns and the grim reality.

Busch says he was promised an $800,000 annual income starting at age 52 after contributing $1 million for five years. He was allegedly told, “sounds too good to be true, but, you know, got to believe in those that are looking at it for you and telling you to believe it.” The red flag? He got a notice demanding a sixth year of premium payments on a plan that was supposed to be paid up in five.

The IUL Fine Print: Where Did the Money Go?

The lawsuit alleges misleading illustrations, undisclosed costs, and false guarantees. IULs, in theory, offer market-linked returns with downside protection. But the devil is always in the details. These policies often come with high fees (administration, mortality, surrender charges) that can eat into returns, especially in the early years. The agent, according to Busch, made a 35% commission before the money even hit Pacific Life.

It's unclear from the available information exactly how much of the $10.4 million loss is due to fees versus poor investment performance within the IUL. Pacific Life hasn't publicly responded in detail to the allegations, so we only have one side of the story. But even if the market underperformed, the question remains: were the risks adequately disclosed?

The claim that the insurance company isn’t investing in the market but buying bonds is interesting (and possibly a simplification). Insurance companies typically invest in a mix of assets, with a significant portion in relatively safe bonds to meet their obligations. But the specific asset allocation of the IUL, and how it impacted returns, needs further scrutiny. What percentage was actually allocated to the indexed component versus fixed income, and what caps were in place on the indexed returns?

A Cautionary Tale: Sophistication vs. Due Diligence

Busch's story echoes that of an electrician in South Carolina who reportedly lost his $1.5 million retirement savings through a similar IUL scheme. These cases highlight a critical vulnerability: even financially savvy individuals can be susceptible to complex financial products they don't fully understand. As “Money Gone,” Says Kyle Busch After He Lost $10.4 Million in 16 Months reports, the NASCAR driver is taking legal action after the significant loss.

And this is the part of the story I find genuinely concerning. It's easy to assume a NASCAR driver or a business owner has financial acumen, but success in one field doesn't guarantee expertise in another. This isn’t about intelligence, but rather about specialized knowledge. It’s like assuming a brilliant physicist can rebuild a car engine – maybe, but probably not without a lot of help (or a massive instruction manual).

The core problem isn't necessarily the existence of IULs themselves, but the potential for mis-selling and a lack of transparency. Were the risks of the IUL fully explained to Busch, or was he presented with a rosy, unrealistic scenario? And, crucially, did he seek independent financial advice before committing millions?

So, What's the Real Story?

This isn't just about a "rich guy" losing money. It's about the potential for predatory practices within the financial services industry. While personal responsibility is paramount, the complexity of these products demands greater transparency and stronger regulatory oversight. If a seasoned NASCAR driver can be misled, what chance does the average investor have?