Article Directory

Don't Call It a Meme Stock: GameStop's Q1 Results Reveal a New Kind of Company

When I saw the Q1 2025 report for GameStop, I didn't just see a 325% earnings beat or a stunning reversal from a $32 million loss to a $44.8 million profit. I saw the first concrete data point proving a thesis that has been bubbling just beneath the surface of financial news for years. This isn't a story about a "meme stock" anymore. This is the story of a paradigm shift—a fundamental rewiring of the relationship between a company, its customers, and its owners.

For years, the narrative from legacy institutions has been one of impending doom. A brick-and-mortar relic in a digital world, a company propped up by nothing more than internet hype. And yet, the numbers that just dropped tell a completely different story. A 21.8% jump in revenue isn't a fluke; it's a signal. And the source of that signal is where this story gets truly fascinating. It wasn't some complex financial engineering or a pivot into an unrelated industry. It was a Pokémon distribution event.

Think about that for a second. In an age of digital downloads and cloud gaming, GameStop proved it could still be a nexus, a physical hub for a passionate community. You can almost feel the energy: the buzz of the line outside, the shared excitement of fans getting something they couldn't just click-to-download at home. This event demonstrated that their physical stores aren't a liability; they are a strategic asset for creating experiences, a moat that pure e-commerce players can't cross. But the real breakthrough here isn't just about selling games. It's about understanding that the company's greatest asset isn't its inventory—it's the community that believes in it.

The Community as a Decentralized Engine

Let’s talk about the elephant in the room: the retail investors. The data shows that a staggering 77.3% of this community believes the stock's "fair value" is around $120 a share, a far cry from its current price. The easy, cynical take is to dismiss this as delusion. But I see something far more profound. I see a decentralized, collective belief system functioning as a long-term strategic engine.

This reminds me of the early days of the open-source movement with projects like Linux. A legion of passionate, globally-distributed individuals, written off by the corporate monoliths, collaborated to build something revolutionary. They weren't motivated by a quarterly report; they were driven by a shared vision. The GameStop community is a new iteration of this phenomenon—it's not just about spreadsheets and P/E ratios anymore it's about a digitally-native, hyper-connected community acting in concert to rewrite the rules of value creation right before our very eyes.

What happens when a significant portion of a company's owners are also its most fervent customers and advocates? What does it mean when that group has a long-term vision that transcends the myopic focus on next quarter's earnings? These aren't just academic questions anymore. GameStop is the live experiment. This community isn't just "holding a stock"; they are providing a powerful, stabilizing force of conviction that allows the company to weather storms and make long-term bets that a traditional, fear-driven institution never could.

A New Metric for Value

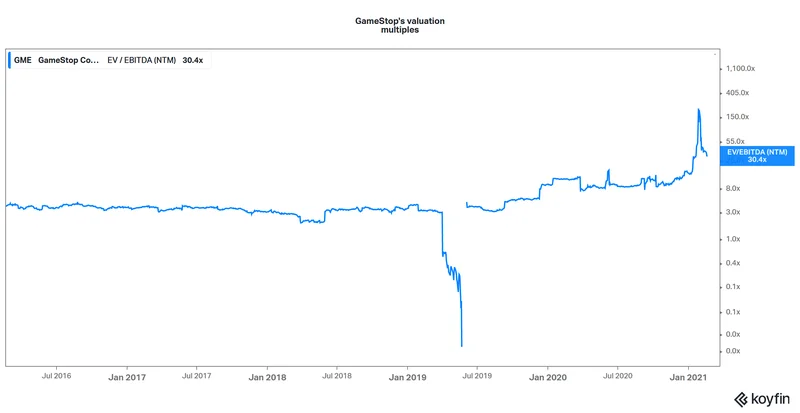

Of course, the traditionalists will point to the numbers and scoff. Analysis like GameStop (GME): Assessing Valuation After Revenue Beat and Pokémon-Driven Earnings Momentum will highlight the company's Price-to-Earnings ratio, which sits at a lofty 33.6x—in simple terms, that means investors are paying a huge premium for every dollar of profit, far more than for its industry peers. They'll point to the risks, from crypto market volatility to the sustainability of its cost-cutting. And they aren't wrong to do so. But they are measuring with a broken ruler.

They are trying to value a network using the metrics of a factory. The high P/E ratio isn't a sign of conventional overvaluation; it's a "belief premium." It's the market's attempt to price in an intangible but incredibly powerful asset: the unwavering conviction of a massive, coordinated community. This is a company with an army of millions of brand ambassadors who also happen to be its shareholders. How do you quantify that on a balance sheet? The honest answer is, you can't. Not yet.

This is the kind of breakthrough that reminds me why I got into this field in the first place. We're witnessing the birth of a new corporate structure, a hybrid between a publicly-traded company and a community-owned cooperative. With this new power, of course, comes immense responsibility. The community has a duty to champion the long-term health of the business, not just the stock price, and the company has a duty to honor the faith that this new class of owners has placed in it. It’s a delicate, symbiotic dance that we’ve never seen on this scale. But if this quarter is any indication, they’re starting to learn the steps.

This Isn't a Stock, It's an Experiment

Forget everything you think you know about corporate valuation. GameStop's Q1 results are more than just a financial report; they are the first successful data transmission from the future. We are watching a live-fire test of a "Community-Centric Corporation," where the line between customer, owner, marketer, and strategist has completely dissolved. This isn't about nostalgia for video game stores. It's about a powerful, digitally-organized collective showing the world that belief itself can be a tangible, value-creating asset. And this experiment is just getting started.